XEN Crypto is a minting token following the first principles of blockchain. It brings us back to what crypto was meant to be when Satoshi created Bitcoin. Crypto lost its ethos with every centralized chain and token created. Today, XEN is going multichain to change things anew, increase adoption, and unite the people under one sign.

According to Jack Levin, the founder of XEN Crypto and faircrypto.org, XEN will launch first on Ethereum and then a few days later on other networks such as Polygon/MATIC, BSC, Avalanche, and ETHw (or ETHpow), and more chains will be added later. To this day, the XEN Crypto smart contract has been tested in different sandboxed environments like Ethereum’s Goerli, PulseChain’s Pulse, Polygon’s Mumbai, and BSC’s testnet. Once the smart contract is on the Ethereum chain, it will be automatically copied to PulseChain when that is forked off Ethereum.

“We really want to be amazing on the EVM first so that we can tap into the global Ethereum ecosystem across all chains. There’s no reason why we can’t expand to other chains once we’ve proven ourselves there.And again, we are omnichain. This project is more inclusive than exclusive. We don’t want to build our own chain just to add another revolving door and have a guard posted next to it. This project is for everybody. It’s the first principles, and the first principles of crypto should be touching every human on the planet,” said Jack Levin.

XEN on multiple chains

Focus on EVM chains and the Solidity programming language is Levin’s priority and the right way to create the best project for the people and communities out there. Through cross-chain bridges, blockchains that are EVM-compatible are interoperable. In general, they’re faster, have lower transaction costs, and feature higher capacity compared to Ethereum. However, Ethereum’s security is considered to be higher than that of the other chains.

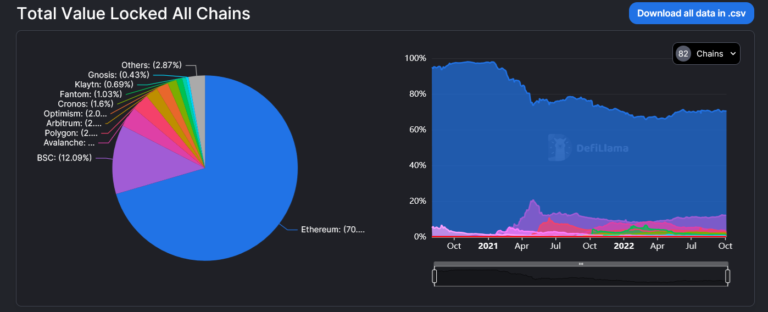

EVM chains with the most total locked value (TVL) are: Ethereum, BSC, Avalanche, Polygon/MATIC, Arbitrum, Optimism, Cronos, Fantom, and others.

It is expected that most value will sit on the Ethereum blockchain because this is where gas fees cost the most. The activity may be higher on other chains due to the low cost per transaction, speed, and capacity, but the price will be higher on Ethereum. When XEN gets sold on a decentralized exchange like SushiSwap or Uniswap, the sellers will want to sell it for a price higher than the cost of production and the time spent to produce it. The cost of production is counted in gas units, and it depends on factors like ETH price, base fee, tips, and network activity. Users’ interactions with the XEN Crypto contract are expected to drive up the price of gas to new highs.

transaction Cost on different chains

Ethereum block time is 10–20 transactions per block. One block can contain 30 million gas in transactions. One XEN claim transaction costs 175,000 gwei, which means that one block can fit 171 claim transactions. For a 10 second block time, there will be 1028 transactions in one minute. Users minting with multiple addresses and bot activity could fill up the blocks, making XEN transaction activity prevalent on the chain. At press time, the base fee is 30 gwei and the tip is 2 gwei. According to the gas price formula, where:

Total Gas Fee = Gas units (limit) x (Base fee + Tip)

Our claimRank will cost us:

175,000 x (30+2) = 5,600,000 gwei

0.0056 ETH multiplied by $1,348 USD (current ETH price) equals $7,54 USD.

On other chains, gas fees are much lower. For example, on BSC, the base price is just 5 gwei, and the price is in BNB, where 1 gwei is equal to 0.000000001 BNB.

XEN claimRank gas on Ethereum costs 175,000 gwei while the cost of minting tokens is 90,000 gwei. Here, we report the cost of the claimRank transaction on other chains that have been tested so far:

BSC: 163,000 gwei

Pulse: 175,000 gwei

Goerli: 177,000 gwei

Mumbai: 174,000 gwei

XEN cross-chain transfers

The contracts on different chains will have the same code, but different addresses, and the tokens will be different by virtue of chain provenance. On BSC it will be bXEN, on PulseChain it will be pXEN and each of them will have a different supply and a different Global Rank and they won’t merge.

They won’t be traded at a 1:1 ratio because the economic energy required to produce the tokens and the security of a chain can’t be arbitraged. There will be a ratio of exchange set by the liquidity pools (LPs). XEN will be traded across different bridges, and on SushiSwap it will be traded through the Stargate protocol with a unified liquidity pool that makes the whole process of swapping so simple that it can be completed in just a few clicks. Sending XEN between Polygon and Ethereum through SushiSwap’s Stargate means that the user will enter the pool of Polygon XEN on the Polygon chain and will receive Ethereum XEN on Ethereum in a ratio set by the LPs. This exchange happens as an atomic swap of the native assets with USDC or USDT as a medium of exchange under the hood. At the time of press, Stargate had $499,273,017.87 in total locked value across the multiple chains it operates on.

The price of transactions on EVM-compatible chains will be very low, and it will be the place with the lowest barrier to entry for many participants. It’s difficult to predict what will happen on EVM-compatible chains, but we can expect very high activity and a high XEN supply. This may create some sort of utility for XEN other than being the medium of exchange; otherwise, the activity may extinguish itself due to a too-low value.

The value of XEN

The price of XEN will depend on many factors, and they include:

- Gas and ETH prices

- Utility

- Size of the community

- User activity

- Disinflationary effect

- Time to wait

“The value is actually created when everybody joins, then the time difficulty creates less and less mintable supply over time, which is what will make people more inclined to buy it rather than spending longer and longer time to mint” said Jack Levin.

Buying someone else’s time to wait will be something people will do because they won’t want to wait for their mint to end, so they will prefer to just go to a DEX and buy it. This activity is what will drive the price up, especially after eight years, when the inflation will be the lowest.

Conclusion

XEN is designed to be chain-agnostic and to lower the barriers of entry for newcomers. It upholds the first principles of blockchain and ensures a fair launch for everyone. Although it’s a multichain token with the same code, XEN is not the same thing on each of them because the economic energy put in its production differs, and users will need to decide where they’re going to focus their attention on to mint XEN.